Reshaping the Corporate World: The Transformative Journey of Alvarez & Marsal

Reshaping the Corporate World: The Transformative Journey of Alvarez & Marsal

Introduction

Alvarez & Marsal (A&M) is a global professional services firm known for its expertise in turnaround management, performance improvement, and business advisory services.

Founded in 1983, the firm has grown into a trusted advisor for organizations facing complex challenges, providing strategic solutions that drive sustainable growth and operational excellence.

This case study delves into the history, services, key projects, and impact of A&M on the global consulting landscape.

History and Background

Founding and Early Years

- Establishment: A&M was founded in 1983 by Tony Alvarez II and Bryan Marsal in New York City.

- Mission: The founders envisioned a firm that would specialize in turnaround management and corporate restructuring, assisting companies in financial distress.

- Early Successes: In its initial years, A&M made a name by successfully restructuring several mid-sized companies, establishing a reputation for hands-on leadership and operational expertise.

Expansion and Growth

- Diversification: Throughout the 1990s, A&M expanded its services beyond turnaround management to include performance improvement and business advisory.

- Global Reach: The firm opened offices across the United States and internationally, establishing a presence in Europe, Middle East , Latin America, and Asia.

- Employee Growth: From a small team at inception, A&M grew to employ over 5,000 professionals worldwide by 2023.

Services Offered

Corporate Transformation

- Turnaround Management: Assisting companies in financial distress to stabilize operations and restore profitability.

- Interim Management: Providing seasoned executives to fill leadership gaps during transitional periods.

Performance Improvement

- Operational Efficiency: Enhancing processes to reduce costs and improve productivity.

- Revenue Growth Strategies: Identifying opportunities to increase market share and expand into new markets.

Business Advisory

- Transaction Advisory: Supporting mergers, acquisitions, and divestitures with due diligence and valuation services.

- Regulatory and Risk Management: Helping organizations navigate complex regulatory environments and mitigate risks.

Disputes and Investigations

- Forensic Services: Conducting investigations into fraud, corruption, and other financial irregularities.

- Litigation Support: Providing expert testimony and analysis in legal proceedings.

Key Projects and Case Studies

Lehman Brothers Bankruptcy (2008)

- Role: A&M was appointed as the restructuring advisor during the largest bankruptcy filing in U.S. history.

- Actions Taken:

- Managed the liquidation of assets totaling over $600 billion.

- Coordinated with creditors, stakeholders, and legal entities to maximize recovery values.

- Outcome: Successfully navigated the complex proceedings, setting a precedent for large-scale bankruptcy management.

Restructuring of Dubai World (2009)

- Challenge: Dubai World faced a debt crisis impacting global markets.

- A&M's Contribution:

- Led negotiations with creditors holding over $25 billion in debt.

- Developed a restructuring plan to extend debt maturities and stabilize operations.

- Result: Restored investor confidence and facilitated Dubai World's recovery.

Performance Improvement for a Global Manufacturing Firm (2015)

- Objective: Address declining profits due to operational inefficiencies.

- Strategies Implemented:

- Streamlined supply chain processes.

- Implemented cost-reduction initiatives across multiple departments.

- Impact: Achieved a 15% reduction in operational costs and improved profit margins within a year.

Impact on the Industry

Thought Leadership

- Publications: A&M professionals frequently contribute to industry journals, sharing insights on restructuring and performance improvement.

- Seminars and Workshops: Hosting events to educate industry leaders on best practices in corporate transformation.

Innovation in Consulting

- Data Analytics: Leveraging advanced analytics to inform strategic decisions.

- Customized Solutions: Developing tailored strategies that address unique client challenges rather than one-size-fits-all approaches.

Influence on Global Practices

- Setting Standards: A&M's methodologies have influenced standard practices in turnaround management and restructuring.

- Collaboration with Regulatory Bodies: Working with governments and regulatory agencies to shape policies that facilitate effective corporate restructuring.

Organizational Structure

Leadership

- Tony Alvarez II and Bryan Marsal: Serving as Co-Chief Executive Officers, they continue to guide the firm's strategic direction.

- Executive Committee: Comprising senior leaders who oversee global operations and service lines.

Global Offices

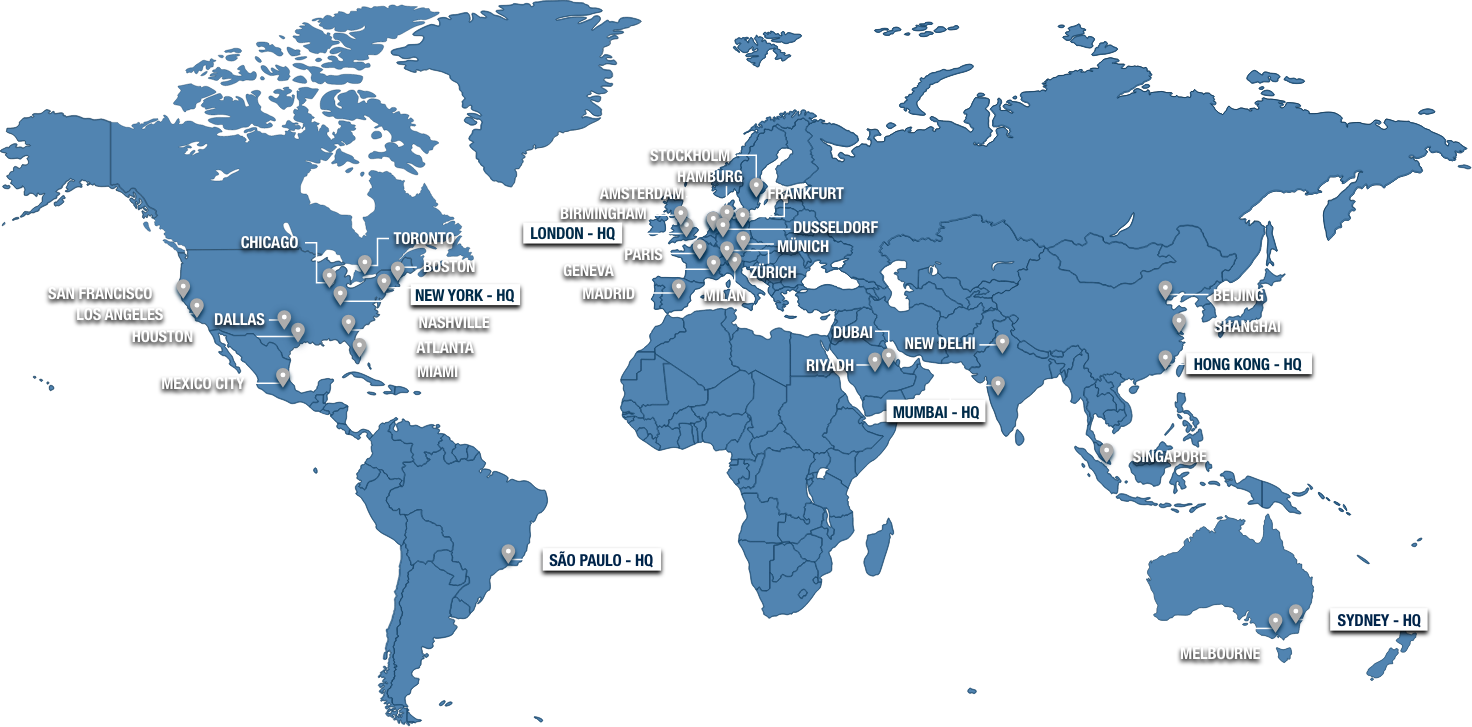

- Americas: Extensive presence across major cities in the United States, Canada, and Latin America.

- Europe, Middle East, and Africa (EMEA): Offices in key financial centers like London, Frankfurt, Dubai, and Johannesburg.

- Asia-Pacific: Established in markets such as Hong Kong, Shanghai, Tokyo, and Sydney.

Talent Development

- Recruitment: Attracting top talent from leading universities and industry backgrounds.

- Training Programs: Investing in professional development through continuous learning opportunities.

Financial Performance

Revenue Growth

- Steady Increase: Consistent annual revenue growth, reaching an estimated $2 billion by 2023.

- Diversified Income Streams: Revenue generated from a balanced mix of services and global markets.

Profitability

- Margin Maintenance: Maintaining healthy profit margins through efficient operations and high-value services.

- Reinvestment: Allocating profits towards expansion, technology adoption, and talent acquisition.

Challenges and Opportunities

Challenges

- Market Competition: Facing stiff competition from established consulting firms and emerging boutique advisors.

- Economic Uncertainties: Navigating the impacts of global economic fluctuations on client demand.

- Regulatory Changes: Adapting to evolving laws and regulations across different jurisdictions.

Opportunities

- Digital Transformation Services: Expanding offerings in digital strategy and technology implementation.

- Emerging Markets: Capitalizing on growth opportunities in developing economies.

- Sustainability Consulting: Advising clients on environmental, social, and governance (ESG) initiatives.

Corporate Social Responsibility

Community Engagement

- Philanthropy: Supporting charitable organizations and community projects globally.

- Volunteer Programs: Encouraging employee participation in social initiatives.

Sustainability Practices

- Environmental Impact: Implementing eco-friendly practices within the firm.

- Ethical Standards: Upholding high ethical standards in all business dealings.

Conclusion

Alvarez & Marsal has established itself as a leader in professional services through its commitment to delivering practical solutions and tangible results. With a strong foundation in turnaround management and a diversified portfolio of services, A&M continues to influence the consulting industry significantly. The firm's ability to adapt to changing market conditions and anticipate client needs positions it well for future growth and continued success.

Comments

Post a Comment